The car-buying process is a frustrating chore; it’s stressful, takes hours of precious time and once you finally seal the deal you’re never certain if you got screwed like a box of Phillips-head fasteners. But before you sign your life away, is it better to finance a vehicular purchase or pay cash? Not surprisingly the answer is a clear as a jar of peanut butter.

Like so many things in life there’s no simple answer, rather a bushel basket of variables to carefully consider before cutting a big fat check or calling your credit union to talk about interest rates. Which option is right for you depends on a number of factors.

MONEY TALKS, BS WALKS

Let’s start with cash, since it’s the simplest of these payment options. In one form or another currency has been around for thousands of years. Depending on location and millennia, people could trade anything from precious metals and jewelry to livestock or even otter pelts to get something they needed.

Beyond all of this Dixon also said, “You don’t have to worry about your equity position,” a potential situation where you end up owing more than the vehicle is worth when you go to sell it. This is commonly known as being “upside-down.”

Aside from potential monetary savings, hard-money transactions afford you other attractive benefits. Colin Bird, an automotive analyst for Mintel, a market research firm said, “When you purchase the car with cash you can do whatever you’d like with it.”

Have you had your eye on a fancy body kit or super-cool LED smoked tail-lamps? Paying cash affords you the ability to add these items if you feel so inclined. Also, you can sell the car outright since there are no lenders to fuss with or liens to sort out.

But paying cash isn’t perfect. “Cars obviously cost thousands of dollars” Dixon said. Understandably not a lot of people have an extra 30 grand lying around. Additionally, squandering the big stack of Benjamins you had socked away under the mattress affects your financial liquidity. This means you no longer have cash handy for other things, like an unexpected a urethral tear received during a square-dancing class, to give an oddly specific example.

Shop for a New Car

Bird said, “Paying in cash is appropriate if you’re planning on keeping that vehicle for 10 years I would say… [Also], if you’re anxious about monthly payments or unsure about income in the future.” But he also noted, “If you’re pretty confident what’s going to be in the future, if you’re income is pretty stable, you should think of financing.”

A POUND OF FLESH

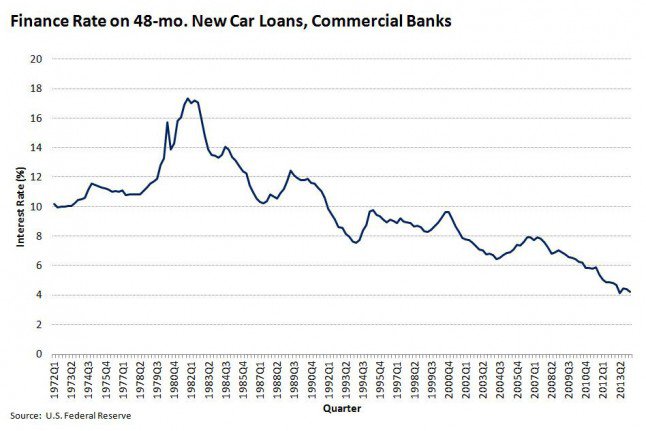

Now let’s explore the benefits and downsides of financing a new-vehicle purchase. Teeing things up Dixon said, “Today’s environment is extremely advantageous for consumers,” because interest rates are so freakin’ low.

Here’s a little perspective. According to the Federal Reserve, back in the early 1980s finance rates for a 48-month new-car loan from commercial banks spiked at nearly 18 percent!

Based on actions taken by the U.S. Federal Reserve bank, Dixon mentioned consumers have anywhere between 12 and 18 months to act before interest rates start inching upward. Fortunately he said they shouldn’t spike suddenly, but gradually trend higher.

Bird agreed, saying “if consumer financing is artificially low, go for it.” This can free up other funds that you can invest in other areas and make more money, a potential win-win.

Bolstering this argument with hard numbers, Bird mentioned that vehicle financing has grown in popularity recently. He said there was $863 billion in outstanding automotive debt last year and that it increased by $18 billion in the last quarter of 2013 alone. It seems low interest rates are driving new-vehicle sales.

Breaking that nebulous figure down into something manageable, Bird mentioned that the average new-car buyer is paying about $500 per month for five and a half years. What’s your payment?

Beyond these issues Bird said “financing is a disadvantage if you have poor credit.” He mentioned you could pay anywhere between 10 percent to 20 percent interest on a loan.

This is something that can be doubly bad for low-income customers. Bird said, “If you have poor credit you usually don’t have savings” and that means you won’t have very much money to put down on a vehicle purchase in order to get a lower interest rate.

USED, PRE-OWNED, SECOND-HAND, ETC.

So far we’ve been dealing in the realm of new vehicles, but things are a little different when you venture into the pre-owned world.

Shop for a Used Car

But this isn’t the case with every second-hand automobile. Dixon mentioned that interest rates for certified pre-owned (CPO) vehicles are much closer to those of new models. These cars and trucks typically cost more than non-certified vehicles but they’re almost always rigorously inspected, mechanically sound and backed by some sort of supplemental warranty. Accordingly, CPO vehicles often have lower interest rates, something Dixon said could, over the life of the loan, “offset some of those upfront costs.” Learn more on this page if you’re planning to buy used RVs.

CASH VS. FINANCING

There are benefits to both financing a vehicle and paying cash for one. Hard-currency customers are free and clear the moment they drive off the lot; they can sell their new ride immediately, they’re free to modify it and they never have to worry about monthly payments or interest fees.

Unfortunately most people don’t have thousands of dollars buried in coffee cans sprinkled around their backyard. This is why financing is so popular; in fact according to Experian data, in the fourth quarter of 2013 only 16 percent of all vehicles that were titled did NOT have a loan attached, meaning the buyer paid cash; the overwhelming majority of customers took advantage of financing.

For most consumers, going with a loan is the best option because money is so cheap to borrow. “It’s a great time to buy from a finance standpoint,” Dixon said, but ultimately that decision up to you.