Inventory on dealer lots balloons to multiyear peak, as auto makers scramble to set another annual volume record

North American car and light-truck production hit an August record last month, despite cooling demand, leaving dealer inventory at a multiyear peak and setting the stage for potentially generous sales incentives this fall.

General Motors Co. led the auto industry with a 21% increase in output to 372,678 vehicles produced in the region, according to data provider WardsAuto.com. Overall, Wards estimates 1.69 million vehicles were produced in the U.S., Mexico and Canada last month.

The production surge comes even though retail demand for new vehicles is flagging and consumers’ appetite for used cars in good shape appears to be strengthening.

The No. 1 U.S. auto maker by sales earlier this year was short of certain high-demand vehicles a factor in pushing its U.S. market share to the lowest level in several decades.

Auto makers’ overall September production is forecast to grow modestly, according to Wards, with GM continuing to ramp up its output. Wards forecasts a slight increase for full-year industry production.

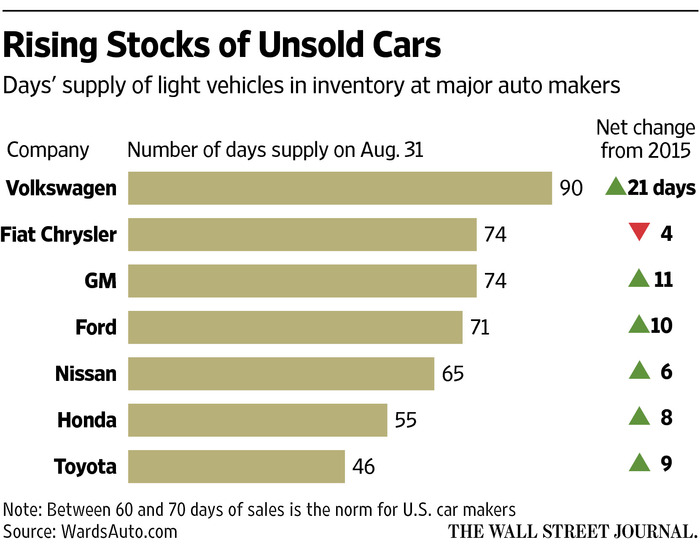

The auto industry’s 61 days of supply at August 31 marked the second consecutive month that overall stock levels hit a 12-year high.

Haig Stoddard, Wards’ industry analyst, said soft August sales in part led to the higher inventory levels. Even if the industry finishes 2016 on a strong note, Mr. Stoddard said, auto makers won’t need to increase output at North American factories, given the glut of dealer stock available.

The boost in production over the summer months could help lift third-quarter financial results at GM, Toyota Motor Corp., and others when figures are posted next month. Besides GM, several car makers increased output during summer months.

Car companies book revenue and profits on wholesale deliveries, not sales to end users. A glut, however, can bite the industry if higher costs for sales promotions are needed to move dealer inventory.

While light-vehicle sales through August were slightly ahead of 2015’s record pace, auto makers have been paying more to keep demand humming.

Researcher J.D. Power estimates retail sales, or deliveries to individuals at dealerships, fell 1.3% to 9.3 million over the first eight months of the year compared with the same period in 2015. Overall sales are up less than 1% over that period, buoyed entirely by fleet sales to rental car companies and government and commercial buyers.

Car buyers received a $3,378 in incentives on a new purchase in August, according to Autodata Corp., or a 10% discount. Incentive spending is up 12% compared with the previous year, according to the firm, driven largely by increases at Ford Motor Co., Fiat Chrysler Automobiles NV, GM and Toyota.

In a note to investors earlier in September, Morgan Stanley auto analyst Adam Jonas said higher inventory and spending on discounts were fueling concern the U.S. auto market has peaked.

But Mr. Jonas also said car companies have plenty of tools to keep buyers interested. Cheap financing, including subsidized leases and low-interest loans, has helped keep payments low. “We would not underestimate the industry’s ability to keep the cycle going,” Mr. Jonas said, after auto sales fell short of expectations in August.

Auto executives, however, must combat the growing supply of late-model used cars flooding the market as leases expire or qualified buyers look to update their vehicles.

On Wednesday, used-vehicle retailer CarMax Inc. said same-store car sales grew 3% in the fiscal second quarter, and selling prices crept up 2.3%. Revenue growth lagged behind its expectations and profit declined during the quarter because of one-time charges and lower store traffic.

Black Book, which tracks car prices, says used-car values are beginning to erode compared with a year ago on vehicles made since the U.S. financial crisis. The decline reflects increased supply.

New-car pricing is threatened when buyers are paying less to get used cars in good condition.